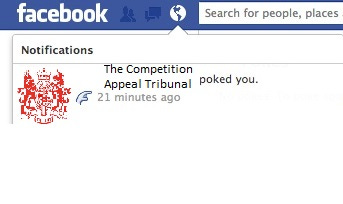

A “poke” from the UK Competition Appeal Tribunal

Did anyone really lose out from Facebook’s use of data?

When, how, and on what basis is the use of data by a consumer-facing website the basis for a class action lawsuit? This topical question is currently before the UK Competition Appeal Tribunal (the “CAT”) in Gormsen v Meta. The claim alleges that Facebook took too much data in breach of UK competition law, and that Facebook users should be compensated for this. The claim faced a setback today (Feb. 20, 2023) when the certification of the class was deferred pending methodology revisions – in layman’s terms, the CAT was not convinced of the claim.

Recently, the CAT had heard arguments on the crucial question of class certification, that is, whether there is a common loss suffered by claimants such that a Collective Proceedings Order (“CPO”) can be granted. The UK Supreme Court precedent Merricks v MasterCard guides this question, and requires a common methodology to be clear before a CPO can be granted. The hearing transcripts provide a bellwether for how the CAT is likely to approach several core questions relating to class actions for online data use:

1. Is there a loss?

2. If there is a loss, is it amenable to a common methodology?

3. How should associated benefits in related “multi-sided” markets, e.g., advertising, be accounted for?

1. Whether there was a loss

It is axiomatic that loss must be proven for there to be a claim in English private law, be it for contract or tort. Indeed, the facts of the colourful case that provides the exception, Attorney General v Blake, emphasise how difficult it is to depart from the proof of loss. The late double agent, George Blake, had fled to Russia and wrote his memoirs in exile. However, the publication of the memoirs created a profit, including to the reading public who had consumer surplus (and a free speech interest) in the memoirs. The advance from the memoirs was stripped out by the Supreme Court, despite no proof of loss from them.

Some might say that the court missed an elegant opportunity to uphold (i) the rule of law and (ii) free speech in the context of the cold war: what could have been more apt, on these facts, than simply saying “publish and be damned”? That would have limited government intervention so as to preserve free speech. By leaving the choice to read the book firmly with the audience, it would also have been an understated contrast with the puzzling title chosen by Blake, No Other Choice. Whatever one’s politics, it would seem tolerably clear that communism is about the removal of choice: the disagreement is whether that is for better or worse.

It takes spectacularly unusual facts like these for the English courts to relax their requirement to prove loss in contract and tort claims. More recent precedent seems particularly frosty towards stripping out gains: consider, e.g., One Step, a 2018 precedent in which the Supreme Court hemmed in the use of accounting for profits in business law settings and instead required clear proof of loss.

Practically, the ability to trade subject only to compensating for proven loss, and not to have to account for gain, is a major element of business liberty in England and Wales. Consider the facts of the (more obscure) precedent in Nottingham University v Fishel: There, an enterprising researcher in early IVF and student of the pioneer Professor Robert Edwards had undertaken additional work for a private clinic in addition to his University post. Eventually, Dr. Fishel came to make more money than anyone else at the University, including the Vice Chancellor, prompting resentment: the University even undertook early forensic analysis of his laptop to find out about private clinic invoices.

But as Dr. Fishel had undertaken all his duties, the University was unable to prove a loss. Instead, it directed him to discontinue the work, but as the High Court pithily noted “Unsurprisingly, Dr. Fishel was resistant to any change.” Carrying on the external work would then be a breach of contract, as it would breach the University’s power to direct the employee. But what loss is disclosed if a recalcitrant employee disregards the instruction?

To the relief of those who benefited from Dr. Fishel’s clinic, or who simply take a dim view of the envy shown by the University, the answer was that the extra work did not harm anybody and therefore gave rise to no damage. Dr. Fishel might have breached his contract, but he had done his job. Thus, even if he breached his contract, it was what an economist would call “efficient breach”. Without citing the term, the court upheld the substance of efficient breach by requiring proof of a loss before a plaintiff may claim money from anybody else.

Indeed, the productivity value in English life (witness the cultural prominence of bees) is visible in the tone set by the court: approving comments included that as an early researcher “Dr. Simon Fishel was well placed to develop his skills, and he made full use of his opportunities.” The court even lists some of his notable IVF innovations in its review of context. Quite right too: many owe their lives and families to Dr. Fishel, which is more than can be said for the envious bureaucrats who actively depleted Nottingham University’s resources to make his life hard. What, precisely, is the gain to society from costly intervention in a case like Fishel’s, where there is no provable loss, and considerable gain? Here, the University could easily have spent its time and money on something more productive than persecuting its star researcher.

Strikingly, this aspect of English legal culture – or perhaps, common law culture – contrasts with the position on much of continental Europe, and for that matter some of the more continentally-influenced parts of the British Isles. In a civil law jurisdiction, a gain might well be stripped out as “unjust” unless its basis can be affirmatively shown, as could also occur within the UK in the civil-influenced Scottish legal system. Perhaps the most prominent reference is in para 812 of the Burgerliches Gesetzbuch (BGB), or German Civil Code: “A person who through an act performed by another, or in any other manner, acquires something at the expense of that other person without legal ground is bound to render restitution.” While that is a complex provision and given to its own interpretation, the emphasised section above effectively requires proof of a valid basis for a gain, as opposed to leaving people be unless there is proof of loss. This effectively reverses the burden of proof and requires, at some level, justification of a gain. While this is applied to some proprietary claims in English law, it has hardly ever been accepted for a standard contractual claim, and for good cause. Someone else’s gain is neither here nor there unless there is a property right involved so as to require their consent: see e.g., Kleinwort Benson; Lipkin Gorman. And the same focus on loss, rather than on gain, can be seen in the leading tort precedents, e.g. Smith New Court.

For the common lawyer, the civil law emphasis on accounting for gain is puzzling since the gain to another (as opposed to loss) is only of interest if there is an envious preference. Otherwise, it is an irrational focus: you getting a Rolls-Royce makes me no worse off (whereas when you crash it into my Ford, it does make me worse off). In application to the Facebook case, the act of media sales of this large publisher’s inventory, is not an acquisition that comes at the expense of users of its property. It may well be that the different legal systems are reflecting different emphasis on egalitarian vs liberal values here: one is requiring people to justify themselves; the other is showing a preference for liberty unless harm is caused.

Indeed, Gormsen’s counsel’s repeated emphasis in the CPO trial transcript on the scale of Facebook’s turnover and loose but clearly negative insinuation between this success and data handling may disclose an envious, or at least egalitarian, worldview. It would have been much more interesting to hear of the costs and benefits of that data handling from a net societal welfare point of view, perhaps applying insights from the famous tort theorists (e.g., Posner, Epstein, Coase, Calabresi). Instead, the transcript emphasises the fact that someone had built a profitable business – missing the point that in itself, that is simply an improvement to societal welfare.

So, in the proof of loss requirement, there is a fundamental difference on display in the role of authority: is it only to make good when someone has been harmed, as on the common law approach; or is it, in some broader sense, to use authority to enforce the law – at some level, for the sake of it, out of respect for the law per se and without regard to context?

Which is really narrower in UK competition law litigation: the Atlantic or the Channel?

The particularly thorny issue faced in Gormsen v Meta is the collision of these contrasting worldviews. On the one hand, there is the need to prove loss in English law; but on the other, the case is pleaded under the EU-inherited Competition Act 1998, which is (for now) a word-for-word facsimile of what is now Article 102 of the Treaty on the Functioning of the European Union. Of a piece with the “Napoleonic” view that the law exists to enforce rules upon the population, as opposed to arising from the population, EU competition law is relatively interventionist: (i) in the scope of rules; (ii) in the relatively weak judicial review standards applicable to regulation (review for “manifest error” only), and (iii) in the absence of any example of a part of the EU apparatus, or EU law, winding itself up and saying “mission accomplished – leave it to the market from now on.”

It is on the first of those three points that Gormsen shows a marked contrast with common law views on regulation. Other parts of the common law world, notably the USA, do not permit free-standing challenges to pricing by monopolists: see especially the famous precedent in Verizon v Trinko. The insight behind this is interesting and rarely explored: even if there is a “bad deal” for a consumer in the short run, if there is true market power, then exploitation of it will bring forward innovation to fix it. Thus, the proper scope of the competition rules ought to be only and ever the increase in market power, and never in itself the charging of a high price or exploitation in the short term.

By contrast, Art 102 TFEU does, in theory, allow a claim for excessive prices – but facing a headwind of (i) being derived from public enforcement, where there is more trust in the judgment of authorities to intervene with care as to the risks of overenforcement and (ii) contrasting with consumer protection law, where even the relatively interventionist EU framework does not allow direct challenge to price (see s.62 of the EU-derived Consumer Rights Act 2015).

Seen in this way, the case is the collision of two very different perspectives on the proper role of the CAT: is it to enforce the law, or simply to compensate those who are worse off and can prove it?

Application to Facebook

The Facebook case struggles with the proof of loss. The essential claim is that more data was collected because of market power. This is debatable, especially as regards loss: would less data really serve the consumer better? The relationship between data collection, market power, and consumer welfare is not clear, and there are scenarios where even a monopolist would maximise quality (so as to maximise profitable sales). Moreover, given consumers are not empowered to sell publishers’ ad inventory, it is debatable whether they are even participants in the advertising market in the first place. There are also thorny questions about the safeguards, and whose data is involved: is this personal data of a specific individual, or simply higher-level insight based on privacy-by-design pseudonymous or even anonymous data use?

These issues will be core at trial. Indeed, the CAT fired a warning shot, the presiding judge (Sir Marcus Smith) noting that he was overturned by the Court of Appeal when he attempted to depart from a purely compensatory approach in BritNed v ABB.

2. A common methodology

In the meantime, in addition to the need to prove a loss, there is the challenge of proving a common methodology for loss. Merricks v MasterCard was clear that this should not be too strict a bar, but it must still be proven. What is the common methodology here? Facebook users have wildly different experiences of the platform: some use it a lot; some a little. For every “oversharer” there is a “lurker”. In a sense, the argument that data protection regulation, in the form of the UK Data Protection Act (for now, a carbon copy of the EU’s GDPR), is that each person is different: hence why they are given inalienable rights in data handling (erasures, disclosures, rectification, etc.). Those rights would make little sense unless they are somehow individual. There would be no need for a rectification right, for instance, unless this addresses something that is different about an individual.

And if these rights were amenable to common loss estimation, then that would have been a reason not to regulate, as the data handling would not then be a special case, so as to justify a differentiated regulatory regime. “Plain vanilla” contract, tort and consumer protection law could then be used to assess costs and benefits – and these are notably more lax (e.g., s.62 CRA exempting price and requiring a claimant to show material loss to the average consumer before intervention occurs).

Indeed, if there were a common loss, on a cost-benefit approach, there would be every reason to apply the same stricture, precisely because of the overenforcement risk well-known to consumer protection law: if the preference is average, and not esoteric, then the law ought to check the net costs and benefits of intervention from the average user perspective, to ensure that intervention is not net-negative. That does not follow on a fundamental rights approach, where the whole point is not to average the welfare impacts of regulation – but if the harm is then not average, as we are frequently reminded is the point for GDPR, how then can the loss be commonly specified in one class under one shared methodology as most readings of Merricks require? One can understand the CAT’s reticence.

In a nutshell: if the argument is that data was “abused”, and if the harm from that is to “privacy,” then how can that possibly be the same for everybody? The essence of that argument is that the impacts differ.

The harms ought also to be defined: are they re-identification harms? If so, when did they occur? If there are abuses independent of re-identification, what are they, and why are they common to the class? This needs to be specified at the class certification stage, or it is not clear that the loss is amenable to a common methodology.

On these thorny points, the CAT has asked some very challenging questions to the claimant. Whether conceptualised as unfair terms, or an unfair price, the CAT admitted to “real difficulty” with trying to second guess what it called the “barter” of data for access to a service: “how can we say that the bargain on one side is so unfair as to constitute an abuse”? There is an acute point here relating to the rule of law, in that there ought to be clarity to those regulated. There is a risk that impressionistic approaches would simply second guess the business model and amount to an unprincipled tax or restriction on ad-funded and data-driven business models.

Drawing on an avian analogy, the CAT even opined that tracking the migration patterns of starlings would not be a rational methodology, since although a great deal of data would be collected, it would not relate to the necessary question, which here is the proof of relevant and shared loss. It is interesting to speculate as to whether this is an indirect reference to the use of avian themes in relevant adjacent data handling restrictions, notably Google’s Privacy Sandbox, whose FLOCs, Fledges and Turtledove share this avian nomenclature. It might also be a reference to Monty Python: the airspeed of swallows hinging on the definition as to whether the African or European form is in question, which is given much mirth in Monty Python and the Holy Grail. It is fair to say that a hearing is going badly if a senior judge is quoting Monty Python against you on the record.

There is however a much more serious point lurking behind the starling analogy. Unless there is a clear basis for saying that the harm accrued on a predictable and consistent basis, there is a real risk that a consumer-friendly innovation is shut down or impeded simply because some establishment interests, especially in continental Europe, do not care for the disruption from it and the societal change from this exercise of personal liberty. Here, that liberty is to engage, or not, with a social platform containing decentralised content, rather than to consume centralised messages from figures of authority (state broadcasters). Not everywhere has the decentralisation values of Silicon Valley, especially in continental Europe with its strong emphasis on centralisation (guilds; state funding; regulation of change; and more recently, “ever closer union”). Indeed, is undue regulation of data-driven innovation not a particular risk following the decision of the Belgian Data Protection Authority against the Interactive Advertising Bureau’s Transparency and Consent Framework (TCF)?

3. Multi-sided market dynamics

A final point to note from the transcripts is the discussion of multi-sided markets dynamics. Counsel for Gormsen was at pains to note precedents in UK (and before Brexit, EU) competition law to the effect that where effects need be proven, effects on one side of the market suffice for liability. This derives from case law including the MasterCard litigation. It is, however, dependent on the context of public enforcement where, just as with allegedly excessive prices, the permissiveness of UK and EU law towards enforcers must be cabined by an understanding of the noblesse oblige expected of them. These precedents, however accommodating they may sound, cannot be read 1:1 into the different context of a private damages claim, where the risks of overenforcement are more pronounced.

It is certainly the case that UK competition law does not require proof of net negative impact across two sides of the platform, in contrast with the leading U.S. case, Ohio et al. v. American Express. For example, in the significant comments on point by the UK Competition and Markets Authority in its review of JustEat/HungryHouse, the CMA preserved its ability to run either integrated or separate market analysis, depending on how close the linkages between the two sides of the market are.

In the case of Facebook, where there are clear linkages between the two sides of the market, it would be a narrow-minded court that considered only one side of the market. And even if the request were acceded to, analysis of both sides of the market would nonetheless be required, as part of the welfare function of the user whose access to Facebook’s services is derived from the two-sided market of a publisher selling ad inventory to an advertiser. Here, the consumer is not only using an ad-funded interface, but even sees the adverts and other content direct. Thus, the case is very different from the more cabined group-by-group analysis seen in other cases like MasterCard, where the merchant groups accepting cards faced closer direct linkage to the commercial exchanges between individuals and businesses which comprise both sides of the two-sided market.

Given the digital advertising market is not a mediation between consumers selling publisher inventory to advertisers, it is inaccurate to compare such business-initiated exchanges to consumer-initiated exchanges. It is also unattractive to seek to truncate this analysis, rather than to engage with it, not least as the pass-on defence likely implies that it ought to be addressed (since it affects the overall consumer position).

From which side of the Atlantic will the CAT draw its inspiration in Meta? The case will be an interesting one to watch as UK competition law takes shape following Brexit.

Disclaimer: The author was taught contract law by the presiding judge in the CAT case, Sir Marcus Smith, including several of the points advanced for analysis above, although the usual further disclaimer applies. The author advises on competition law class actions before the CAT, but is not active in the Meta litigation.